Money Market

- It is an important segment of the Indian money market. In this market, banks and primary dealers borrow and lend funds to each other on an unsecured basis.

- If the period is more than 1 day and up to 14 days it is called“notice money”.

- Money lent for 15 days to 1 year is called“term money”.

- No brokers. Settlement is done between the participants through the current accounts maintained with the RBI.

- In general, the call money rate referred to as the overnight MIBOR

Banks borrow in this money market for the following purpose:

- To fill the gaps or temporary mismatches in funds

- To meet the CRR & SLR mandatory requirements as stipulated by the Central bank

- To meet sudden demand for funds arising out of large outflows.

Thus call money usually serves the role of equilibrating the short-term liquidity position of banks

Call Money Market Participants :

- Those who can both borrow as well as lend in the market – RBI (through LAF) Banks, PDs

- Those who can only lend Financial institutions-LIC, UTI, GIC, IDBI, NABARD, ICICI and mutual funds etc.

Reserve Bank of India has framed a time schedule to phase out the second category out of Call Money Market and make Call Money market as exclusive market for Bank/s & PD/s.

Treasury Bills (T-Bills) is a money market instrument, are short-term debt instruments issued by the Government of India, and are presently issued in three tenors, namely, 91 days, 182 days, and 364 days.

It is a Promissory note of the central government and therefore qualifies as being free of credit risks.

It Issued to meet short-term funding requirements of the government account with Reserve Bank.

Treasury bills are zero-coupon securities and pay no interest.

They are issued at a discount and redeemed at the face value at maturity.

The return to the investors is the difference between the maturity value or the face value (that is ₹100) and the issue price

Treasury bills are usually held by financial institutions including banks. They have a very important role in the financial market beyond investment instruments. Banks give treasury bills to the RBI to get money under repo. Similarly, they can keep it as part of SLR.

The T-bill rate is a key barometer of short-term interest rates

T-Bill Sale is by auction. Any individual, corporate, bank, primary dealer, or other entity is free to buy T-Bill.

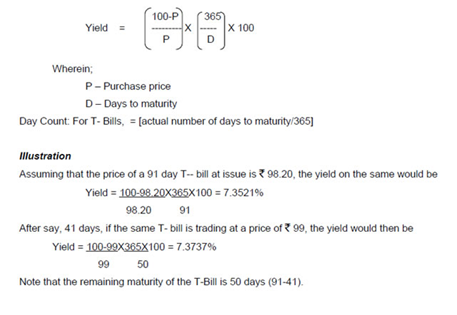

Calculation :

Government securities(G-secs) are sovereign securities which are issued by the Reserve Bank of India on behalf of Government of India, in lieu of the Central Government’s Market Borrowing Programme.

G-Secs carry practically no risk of default and, hence, are called risk-free gilt-edged instruments.

The Principle and Interest both are Unconditionally & Irrevocably guaranteed by the Government of India .

They have maturity ranging from 1 year to 30 years.

No Tax Deduction at source.

Calculation :

An investor who purchases a bond can expect to receive a return from one or more of the following sources:

- The coupon interest payments made by the issuer;

- Any capital gain (or capital loss) when the bond is sold/matured; and

- Income from reinvestment of the interest payments that is interest-on-interest.

The three yield measures commonly used by investors to measure the potential return from investing in a bond are briefly described below:

- i) Coupon Yield

The coupon yield is simply the coupon payment as a percentage of the face value. Coupon yield refers to nominal interest payable on a fixed income security This is the fixed return the Government (i.e., the issuer) commits to pay to the investor. Coupon yield thus does not reflect the impact of interest rate movement and inflation on the nominal interest that the Government pays.

Coupon yield = Coupon Payment / Face Value

Illustration:

Coupon: 8.24

Face Value: ₹100

Market Value: ₹103.00

Coupon yield = 8.24/100 = 8.24%

- ii) Current Yield

The current yield is simply the coupon payment as a percentage of the bond’s purchase price; in other words, it is the return a holder of the bond gets against its purchase price which may be more or less than the face value or the par value. The current yield does not take into account the reinvestment of the interest income received periodically.

Current yield = (Annual coupon rate / Purchase price) X100

Illustration:

The current yield for a 10 year 8.24% coupon bond selling for ₹103.00 per ₹100 par value is calculated below:

Annual coupon interest = 8.24% x ₹100 = ₹8.24

Current yield = (8.24/103) X 100 = 8.00%

The current yield considers only the coupon interest and ignores other sources of return that will affect an investor’s return.

iii) Yield to Maturity

Yield to Maturity (YTM) is the expected rate of return on a bond if it is held until its maturity. The price of a bond is simply the sum of the present values of all its remaining cash flows.

Present value is calculated by discounting each cash flow at a rate; this rate is the YTM.

Thus, YTM is the discount rate which equates the present value of the future cash flows from a bond to its current market price. In other words, it is the internal rate of return on the bond.

State Governments also raise loans from the market which are called SDLs. RBI co-ordinates the actual process of selling these securities.

The structure and nature of SDLs is broadly similar to that of a fixed rate Dated G-Sec. However, these instruments are generally issued for maturities up to 10 years.

Each state is allowed to issue securities up to a certain limit each year.

State Government issue such securities to fund their developmental projects and finance their budgetary deficits

SDLs are dated securities issued through a normal auction similar to the auctions conducted for dated securities issued by the Central Government

Interest is serviced at half-yearly intervals and the principal is repaid on the maturity date.

These are long term infrastructure bonds issued mostly by Public Sector Undertaking (PSU) Companies.

The maturity of these bonds range from 10 to 20 years.

These bonds pay a fixed coupon rate (interest rate) on a specified date.

The interest incomes from these bonds are exempt from Income Tax Act 1961 under

Section 10 (15) (IV) (H).

The Interest Frequency is on annual basis.

TDS is not applicable on Tax-free Bonds.

These are rated by Credit Rating Agencies like ICRA & IRRPL.

A taxable bond is a debt security (i.e. a bond) whose return to the investor is subject to taxes at the local, state, or federal level, or some combination thereof.

• Taxable bonds are subject to taxation from the bondholder.

• Most bonds are taxable. Generally, only bonds issued by local and state governments, i.e. municipal bonds, are tax-exempt and even then special rules may apply.

• You must pay tax on both interest payments and on capital gains if you redeem the bond before its maturity date.

• The tenor of such securities is generally in the range of 10-20 Years

Corporate Bonds refer to securities issued by public/private sector corporates for a variety of business purposes.

These securities are issued by Public Sector Enterprises, Public Sector Banks, All India Financial Institutions, Private Sector Companies, etc. for their business activities.

Companies issue corporate bonds to raise money for a variety of purposes, such as building a new plant, purchasing equipment, or growing the business

The tenor of such securities is generally in the range of 1-15 years. However, the tenor may vary depending upon the funding requirements of the issuer.

Corporate Bonds carry a rating (usually AAA to D) as specified by the rating agencies determined on the basis of the fundamental strength of the issuer.

54 EC bonds or capital gains bonds, are one of the best way to save long-term capital gain tax. Tax deduction is available under section 54 EC of the Income Tax Act. The funds have lock in period of 5 years.

- To avoid tax on sale of property, one can invest in Capital Gain Tax Bonds within 6 months from the sale date of property; one does not have to pay tax.

- IRFC, REC, NHAI, PFC Capital Gain Tax Bonds are available for investment. Click here to view Capital Gain Bond Chart.

| Issuer | IRFC / NHAI / REC / PFC |

|---|---|

| Rating | AAA by CARE, CRISIL & ICRA |

| Face Value & Issue Price | Rs. 10000/ |

| Tenure | 5 years |

| Interest Rate | 5.75% p.a. |

| Minimum Application | Rs. 20000/ |

| Maximum Application | Rs. 5000000/ |

| Minimum Bond | 2 |

| Maximum Bond | 500 |

| Issuance Mode | Physical Mode or Demat Mode |

| Transferability | The Bonds are non-transferable, non-negotiable and cannot be Offered as a security for any loan or advance |

| Interest payment | Yearly |